The 4C Framework for Managing Risk and Compliance in the US

Expanding a business globally can be an exciting endeavour, but it also comes with a multitude of risks and compliance issues that can quickly become overwhelming.

New work culture. New tax regulations. New employment compliance. However, by having the right experts by your side, you can equip yourself with the knowledge to take these challenges head-on!

In a recent episode of the Scale Up Stateside podcast, we spoke with Stephen Rookes, an experienced consultant with Strategic Risk & Compliance Consultancy (SRC) who shared valuable insights on how to navigate these challenges based upon the last 16+ years spent across the recruitment industry in the management of legal and commercial risks associated with international recruitment. You can connect with Stephen via LinkedIn.

Stephen has developed his own 4C framework which can act as a high-level compliance checklist for businesses expanding to the US.

This blog, part-transcribed from the interview above, will break down the key points discussed as part of the 4C framework, providing a comprehensive guide to help businesses tackle the risks associated with growth, and advice on how to remain compliant in the US market.

The 4Cs Framework

“For me, the 4C framework is an aide-mémoire. It is a tool there to help focus our thought processes on the critical issues that impact on the business….so it is not so overwhelming, and we can deal with one issue at a time.”

Compliance

The first C is focused on issues around compliance.

These are issues that are related to the way that a recruitment agency engages contractors in the US for an end client. This is in relation to issues such as worker classification, visas, tax, and data protection.

You can check out Stephen’s full breakdown of ‘Compliance’ here.

Care

“For me, this is probably the most important because this is about the individuals that you place and how you look after them when they are on assignment.”

The Care element of Stephen’s framework revolves around the duty of care recruitment agencies have for the contractor they are placing.

From a legal perspective, the recruitment agency must have the right insurances in place to deal with scenarios that lead to illness, injury, or death. Stephen recommends testing scenarios to ensure that the right communication channels exist between agencies, clients and external suppliers such as medical providers.

This C also extends to efficiently managing the on-boarding and off-boarding of contractors to minimise damage to reputation (or legal action due to claims of unfair termination).

You can check out Stephen’s full breakdown of ‘Care’ here.

Corporate

The third C relates to issues including corporate set-up, shareholder requirements, trade licences, and the possibility of trapped cash.

In terms of the US, businesses must decide how they want to set up their entity or whether they want to use a third party.

Ignorance or lack of attention to detail in this area can lead to severe consequences, including legal penalties and reputational damage. Businesses must conduct comprehensive research and due diligence to ensure compliance in this area.

You can check out Stephen’s full breakdown of ‘Corporate’ here.

Claims

“Ultimately you have got to have the right insurance in place to mitigate the risks associated with potential costly claims.”

The US is a highly litigious market, so it is fitting that the fourth C in Stephen’s framework is ‘claims’.

Stephen warns that these claims could come from several sources, including your clients, your contractors, and even your own staff.

Clients may sue your company for errors on behalf of your recruiters or the contractor that you place. Contractors may bring a claim against you if they feel they have been wrongfully terminated. And claims could be raised from staff if they have been discriminated against or harassed.

Despite careful planning and risk mitigation, unforeseen circumstances can arise during business expansion. It is crucial to have proper insurance coverage and a robust claims management process in place.

You can check out Stephen’s full breakdown of ‘Claims’ here.

Main compliance considerations for the US market

Worker classification

“The golden rule is, by default, always go with W-2. Only by exception, consider independent contractor if they meet the criteria.”

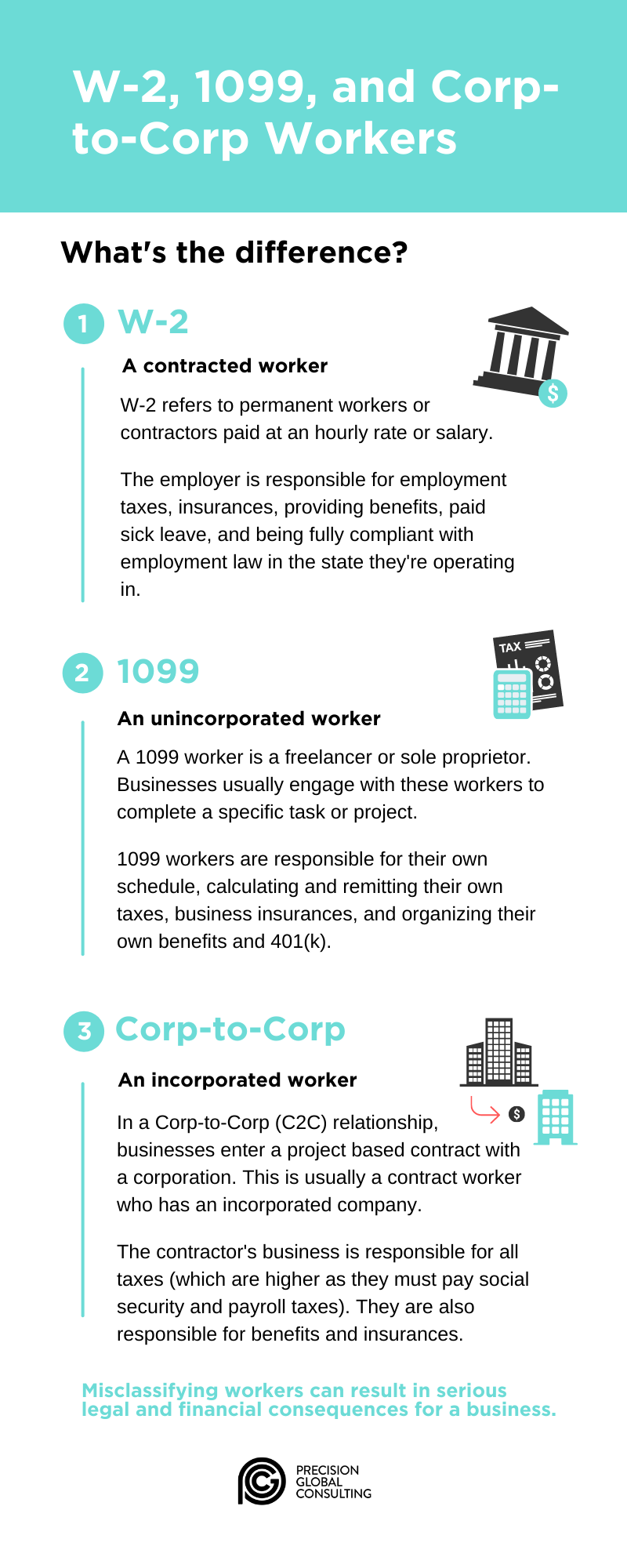

Understanding worker classification is crucial when operating in the US market. In the US, workers are classified as either W2 employees or independent contractors, such as 1099 or corp-to-corp. This classification determines their rights and obligations under the law. It is essential to get this classification right, as misclassifying workers can lead to severe consequences. It is reported that Nike, a global brand, could face fines exceeding $500 million for classifying thousands of workers as independent contractors when authorities argue they should have been employees.

Are 1099 workers the same as Corp-to-Corp (C2C)?

This is a common question we receive from recruitment agencies just entering the US market. 1099 workers and Corp-to-corps are both types of independent contractors. A 1099 worker is an unincorporated worker (a freelancer or sole proprietor), whilst Corp-to-Corp is an incorporated worker. In a C2C relationship, businesses enter a project-based contract with a corporation.

To help aid understanding, we have put together a simple infographic that breaks down the different ways to engage contingent workers in the US (including the most common W-2 employee classification)

Regulatory compliance

“If you classify a contractor as exempt, be aware there is a possibility that when they finish their assignment, they may challenge and argue they were misclassified in order to receive unpaid overtime payments.”

In terms of US regulations, the main piece of employment legislation to be aware of is the Fair Labor Standards Act (FLSA).

Regarding W-2 employees, there are two key classifications: non-exempt and exempt. Non-exempt employees are subject to FLSA regulations, including overtime pay, while exempt employees are not. However, it is advisable to default to classifying workers as non-exempt to avoid potential risks. Overtime is a significant consideration in the US, as employees who work more than 40 hours a week are entitled to one and a half times their regular pay rate. It is crucial to understand the FLSA guidelines and err on the side of caution to avoid legal complications.

Client contracts

“Contracts in the US tend to be far more onerous than they are in the UK. So, you need to assess very carefully the liabilities and your risk exposure and to make sure you have the right insurance.”

Understanding client contracts is a crucial aspect of expanding your business into the US market. It is essential to carefully assess the liabilities and risk exposure associated with these contracts.

One key consideration when reviewing client contracts is the issue of liabilities and indemnities. Understanding your contractual terms and their implications is crucial for protecting your business from potential claims and lawsuits. It is vital to evaluate the potential risks and ensure that you have the appropriate insurance coverage in place. In the UK, insurance for claims from third parties is referred to as Public Liability, while in the US, it is known as General Liability. Additionally, it is important to have insurance from professional negligence in the performance of your recruitment services. In the UK, the insurance for this liability is known as Professional Indemnity. In the US, this is Professional Liability or Errors and Omissions insurance.

Another aspect to consider when dealing with client contracts is the payment terms. It is common for clients in the US to expect longer payment terms than typical to other markets such as the UK. This inevitably can have a significant impact on your cash flow. You either need to hold your ground in your negotiations to agree acceptable payment terms or price the additional financing costs into your pricing

Top tips for businesses considering international markets

1) Engage a service provider

“My first piece of advice is to engage a good service provider, somebody like PGC (Precision Global Consulting) to manage the compliance. It is very comprehensive, it is complex, especially if you are new to the US market,”

Partnering with a reputable service provider experienced in international expansion can provide invaluable guidance and support. They can help navigate the complexities of compliance, local regulations, and cultural nuances.

It can be confusing trying to get your head around compliance issues in the US when you are trying to grow and establish your business. If you want one less thing to worry about, using an employer of record (EOR) is an easy route to managing compliance. The EOR will take on the risks and responsibilities of engaging workers and you will not even have to set up a local entity.

2) Research

“Number two is do some research, do a bit more research and do a lot more research! You can never do enough when you are trying to enter a new international market.”

Before entering any international market, invest time and resources in comprehensive market research. Understand the local demand, competition, cultural factors, and legal requirements to tailor your business strategy accordingly.

Differentiate yourself from competitors by identifying a unique niche in the target market. By understanding the specific needs and preferences of the local audience, you can position your products or services effectively and gain a competitive edge.

At PGC, a major pitfall we see early on with recruitment agencies is that they treat the US as one country. We recommend treating each state as its own separate country as legislation, tax, and business culture will vary on a state-by-state basis.

We have produced a market research checklist which you can download and tick off the actions you need to complete before expanding to the US.

3) Check client contracts

“Be careful of vanity and kidding yourself that this is good business.”

Stephen stresses the need to thoroughly review and understand the terms and conditions outlined in client contracts. It is easy to get caught up in the excitement of expanding into a new market and overlook key details. However, signing contracts without careful consideration can lead to unfavourable terms, burdensome obligations, or onerous liabilities. Taking the time to review and negotiate the contract terms can save you from potential legal complications down the line.

4) Engage a business advisor

“Engage a credible business advisor, someone who has got the battle scars and knows how to guide you through some of these complexities.”

A business advisor can help you navigate the complexities of a new market. They can introduce you to local partners, bringing valuable market knowledge, networks, and resources to support your expansion efforts.

To learn more about the services that SRC provides for businesses looking to expand internationally, go to SRC Consultancy. You can connect with Stephen via LinkedIn.

Ready to Enter the US Market?

Expanding a business into international markets presents both opportunities and challenges. By managing compliance effectively, conducting thorough research, and implementing the top tips discussed, businesses can navigate the obstacles of expansion with confidence.

PGC has over 22+ years of experience helping international companies, specifically recruitment agencies, make their mark in the US market.

If you are interested in seeing what opportunities exist in the US for you, find out how we can help get you started.

Disclaimer: PGC does not endorse any personal views or opinions of the interviewee. All information here is for general informational purposes only and is not intended to be a substitute for professional and/or legal services.