US Staffing Industry Forecast 2023: An Interview With Staffing Industry Analysts

Want the most up-to-date info? We’ve refreshed this piece with Staffing Industry Analysts to assess the outlook for the US staffing market in 2024.

Are you ready to capitalize on the largest staffing market in the world? Navigating a new and unfamiliar market can be a steep learning curve for many staffing agencies but with the right experts by your side, can make it a less daunting venture! And when it comes to the latest staffing market trends, you don’t need to look further than Staffing Industry Analysts.

That’s why we hosted a LinkedIn Live with John Nurthen. John manages the team that delivers Staffing Industry Analysts' international research content. He has over 25 years' experience in the staffing industry. We transcribed this session, which you can also watch above, so you can learn:

The size of the US staffing industry and forecast for 2023

The US staffing landscape (US economic and employment trends)

Trends within the US temporary staffing industry (growing recruitment sectors)

How staffing business leaders can get the most out of the opportunities in the US staffing market in 2023

Keep reading to find out John’s answers to our questions on the US staffing industry.

How Big is the US Staffing Industry Compared to Other Countries?

To evaluate the size of the US staffing industry, we first must look at the overall US economy. The US GDP forecast for 2023 is 0.5% as there is a danger that developed economies could slip into recession this year. Even if they don't, 2023 is likely still going to feel a little like a recession and an inverse of what 2022 was. However, as we move further into 2023, the economy is expected to gradually improve, with the second half of the year likely to be stronger than the first.

To get into the specifics of how big the US staffing industry is, it grew by 28% y/y in 2021 to generate $186.9 billion in revenue. More than the combined staffing revenue size of the UK, Germany, France, Australia, Spain, India, Sweden, Turkey, and Saudi Arabia. The US staffing industry had another successful year of growth in 2022, generating $218 billion in revenue according to SIA’s April 2023 US staffing Industry update. This was $6 billion more than the original $212 billion 2022 revenue projections.

For 2023, Staffing Industry Analysts forecasts the US staffing market is going to experience a slight -2% y/y growth in comparison to the record-breaking revenue experienced in 2021 and 2022 on the back of COVID-19 hiring rebounds.

When you factor in the impacts of US inflation, there's not as much structural growth projected for 2023 however, there are still lots of opportunities to seize in the US staffing industry and growing temporary staffing sectors which, we will explore later in this blog.

Early 2022 data from the US Bureau of Labor Statistics on the performance of the overall US employment market painted a positive picture for 2023. Nonfarm employment increased slightly ahead of expectations and nearly all job sectors in the US grew. There was a slight decrease in temporary help employment specifically and that's been in decline over the past four months. Do note, the comparisons are tough because it comes off the back of a very strong market in 2021.

The standout feature of the US staffing industry in 2022 and 2021 was the healthcare staffing sector. The US staffing industry grew 14% in 2022 and the healthcare staffing market grew 18% from the year before that, it doubled. The healthcare staffing sector was boosted by a pandemic lift, which reshaped the nature of the US staffing industry, making healthcare the largest segment in the US staffing industry.

What do UK Recruiters Need to be Aware of When Entering the US Staffing Industry?

Employment laws differ per state when recruiting in the US

When talking about the US staffing industry to UK recruiters interested in moving to the US, the regulatory environment should be something they should consider. The different laws per state create an administrative burden. Key things you should be aware of include:

The US has a reputation as being a liberal legal environment.

Complex interplay between the federal, state and local laws.

There are very strong legal and cultural differences by state.

This means if you're planning to launch in California, it’s going to be a very different market to launching in Idaho, for instance.

A lot of US staffing agencies move to the UK, and they make the common mistake of not being aware that employment laws differ per state when recruiting. It’s like US recruitment firms expanding to Europe, they think everywhere is the same, whereas France is very different to Germany, and the UK, etc. This is a common mistake UK recruiters also make entering the US staffing industry. They think the US is one country, but employment laws and what is culturally accepratavle is very different from state to state.

The US has strict legislation for contractor classification

UK recruiters entering the US staffing industry should be aware that the US is much more paranoid when it comes to legislation and worker classification. That's something that PGC is very familiar with; ensuring that contractor evaluation and compliance is right when UK recruitment companies are recruiting in the US staffing industry.

US legislation is always changing

UK recruiters need to keep on top of US employment legislation as it is constantly changing. Staffing Industry Analysts publish a quarterly legal bulletin highlighting any changes in legislation globally and there are as many changes in the US staffing market as there are anywhere else in the world. When recruiting in the US you've got to change your processes and maybe even your technology to keep on top of legislation. However, the legislation relating to the US temporary staffing provision is quite good and keeps recruitment agencies compliant.

US workforce legislation is quite liberal

UK recruiters entering the US staffing market are often surprised that it’s quite easy to fire and hire workers in the US vs the UK, which makes it a more transient market to operate in. A consequence of this is that the number of temporary workers as a proportion of the whole US workforce doesn't tend to grow that much. The reason that the staffing market is strong in France is because it's difficult to hire and fire people. To foster a strong staffing market, you need relatively strong employment legislation. Whereas in the US staffing industry, the legislation is comparatively flexible.

Why should UK recruiters enter the US staffing industry?

Shorter US notice periods to recruit and earn fees quicker

The US is a highly transient market because of how easy it is to dismiss workers due to ‘at will’ employment. Interestingly, many UK agencies that start recruiting in US don't notice the practical differences between temporary and permanent employment because US workers can move in and out of roles so quickly.

In the US, if a worker has a permanent contract opportunity, they have no obligation in terms of notice periods or giving reasons why they’re leaving a job which is very similar to contract recruitment in the UK.

The overall culture of at-will-employment in the US is really driving an increase in transient opportunities. This presents a great opportunity for UK recruiters to move to backfill these roles, where often US employees leave jobs with immediate access. US companies are often reliant on recruiters to help them quickly find candidates for positions. If you can quickly provide contract talent for US clients, you're likely to gain a steady stream of income as recruiters are often in-demand to meet the short turnaround times in an at will employment market.

You can place contractors in any US State using an employer of record

In the US it’s difficult to employ people in different states if you're only set up to provide business in one area. If you plan to hire remote workers in other states, it is the same as trying to get somebody to work for you in a foreign country effectively.

A lot of UK recruiters don't realize that in order to place contractors across the US, they need to be registered in every state to engage that contractor and to pay them. This also includes remitting state and local taxes in that state along with the feds. However, by using an employer of record solution like PGC, employment compliance and payroll per state is covered, so recruiters can focus on finding the talent and growing their business, without an entity in each state.

At PGC, due to the recent rise of remote work, we've seen a rapid increase in the number of US contractors spread across numerous states because clients are more comfortable and have the tech to recruit from afar and engage these workers with PGC.

The US generates more revenue than UK staffing market but is less saturated

The global staffing market was worth over $528 billion in 2021, with the US accounting for approximately 31% of that market share. The US is the biggest single market for temporary staffing, followed by Japan and the UK. Interestingly, if you add up all of Europe, it is a bigger market overall than the US. The US has a lot of staffing firms, but it is less saturated when compared to the UK, which has around 28,000 more recruitment agencies. In terms of global market share, the UK accounts for around 8%, while Japan is at 16%. Canada is also an attractive staffing market, ranking third in market attractiveness in a recent SIA report.

The US is too big to ignore

SIA publishes a most attractive staffing market report every year that looks at several different factors in 75 different countries. In the 2022 report, the US was in joint 22nd place alongside Latvia and India, which does make it sound terrific. Canada was crowned the third most attractive staffing market 2022, eclipsing the US in terms of its market attractiveness, mostly due to less strict employment laws.

Canada is a staffing market that people might overlook because the US is more exciting and the largest in the world. However, Canada is a market worth exploring, and PGC can also help recruiters compliantly make placements and payroll contractors in Canada.

Despite, ranking lower than Canada as an attractive staffing market for 2022, the US is a significant player in the global staffing industry, which can’t be ignored. As it is less saturated than the UK staffing market, it remains a highly competitive market to be in with lots of opportunities still present.

What is the US Staffing Industry Forecast for 2023?

Gross Margins from recruiting in the US staffing industry in 2023

Staffing Industry Analysts report on gross margins found that the average gross margins from recruiting in the US is 22.7%. The gross margins range according to the occupation from 15.3% for office clerical assignments to 32.6% for marketing and creative roles.

In 2022, margins lifted across all segments in the US staffing industry due to a skills crisis and labor shortage, but the market is now beginning to grow less strongly as skill shortages have started to cool down. However, the average margins in the US are still significantly higher than in the UK, and can increase dramatically depending on occupation demand and locations you are recruiting in.

What sectors in the US staffing industry saw the most growth in 2022 and are expected to grow in 2023?

The healthcare sector in the US staffing industry experienced exponential growth in 2021, of which after SIA predicted that the industry might go into decline in 2022. Contrary to expectations, the healthcare industry continued to grow in 2022, experiencing an 18% increase in job growth. For 2023, SIA is expecting the healthcare segment of the US staffing industry to decline. It's the only sector in the US staffing industry predicted to decline based on previous exceptional strong growth.

Outside of healthcare, the strongest growing skill segment in the US staffing industry is education staffing, expected to grow by 10% year over year (y/y) in 2023. IT is expected to increase by 7% y/y, finance and accounting by 5%, engineering by 5% and industrial roles by 5% y/y as well. The growth of the US staffing market in 2023, is largely attributed to the weaker health care staffing market is pulling down the overall Yearly growth after two strong years of abnormal growth due to the pandemic demands.

What states have been identified as opportunity areas by Staffing Industry Analysts?

Texas stands out from the crowd

Texas is growing for recruitment

As the US staffing industry continues to evolve, it's crucial for companies to stay on top of the latest trends and opportunities. Recently, Staffing Industry Analysts identified Texas as the state with the most potential for revenue and growth. But what is it about Texas that's making it stand out from the crowd?

Texas has a strong economy that is booming in the technology sector and has favorable tax incentives making it a business-friendly state. Additionally, compared to other states, Texas is experiencing a period of growth and prosperity. Austin is a great example where we've seen a lot of recruiters relocate to. If you’re interested in recruiting in Texas, we published a blog that highlights the best cities in Texas for business.

California remains popular for recruitment

We've also seen a lot of Californian companies leaving California and reestablishing their headquarters in Texas. Driving factors include California’s high corporation taxes, cost of living, and tax incentives. However, California remains a popular area for recruitment due to the sheer size of the market.

We recently highlighted why California has remained a top state our international recruitment clients choose to place contractors in a recent PGC blog:

“Despite the high tax and living costs, heavy employment regulation, and high-profile companies like Tesla announcing they are leaving the state, California still ranks number one in PGC’s top states for recruiting in 2022. Largely driven by the fact that California has the largest GDP in the US and population for recruitment.”

California is the largest state in the US and ranks as fifth-largest economy in the world, presenting enormous profit making opportunities for businesses, and talent to recruit from due to the the high population.

Use Staffing Industry Analysts Geographic Opportunity Tool to Find out the Best States to Recruit in

Staffing Industry Analysts have been tracking trends and opportunities in the US market for over 30 years, providing valuable insights to members. Their geographic opportunity atlas is a hot tool for US onlookers, offering detailed analysis at state, county, and metro levels. This analysis considers various metrics, such as the number of branches, average temp wage, temporary employment, payroll, alongside several other metrics. So, if you're considering recruiting in the US in 2023, we highly recommend checking this tool out to identify the best states to recruit in.

Which Sector in the US Staffing Industry will Generate the Most Revenue and Opportunity in 2023?

Recruiting in marketing

According to the analysis completed by SIA, utilizing anonymized client data collected on a weekly basis, marketing is the segment that came out as the strongest in the US staffing industry 2023 forecast. The reason marketing is growing in demand within recruitment is due to the development of traditional marketing roles in an increasingly digital world. What was traditionally a marketing role now involves a broader range of responsibilities and skills.

There is an opportunity for recruitment agencies to benefit from this skills shortage in market as it's difficult for US clients to find the right people. This reliance on staffing firms in the US may enable recruiters to charge a large amount for sourcing the right talent.

Recruiting in professional staffing roles

While temporary staffing in commercial occupations was down 9% year over year in 2022, professional staffing was only down 3%. This sector is supported by the massive boom in healthcare, and all the segments are down compared to January 2019, benchmarked pre-COVID. However, SIA still believes that there's room for growth in all the professional staffing skill segments beyond in the first half of 2023.

How can Recruiters Utilize the Opportunities in the 2023 US Staffing Market?

You can easily expand your business across states by using our ‘recruit from afar’ method. But before recruiting in the US staffing market, it's important to do your research and understand the market and cultural differences.

Although the UK and the US countries share a language and similar cultural references, there are still significant differences in the way business is conducted in the US.

Hire local US talent

Sending managers from the UK over to the US and expecting them to work miracles is not a viable option when entering the US staffing market. Local US talent will have a better understanding of the culture and market trends, making it easier to navigate the staffing market in the US.

Understand market differences

One thing that sets the US staffing industry apart is the prevalence of Managed Service Providers (MSPs) and Vendor Management Systems (VMSs). If you don't like MSP or the NSA, you might be able to avoid it if you're at the professional end of the market, but it's much more a feature of the US market because the margins have traditionally been largest there.

Recruiting in the US staffing industry can be both challenging and rewarding. By doing your research, hiring local talent, being mindful of cultural differences, and having access to the right data and insights, recruiters can maximize the opportunities available in the US staffing market.

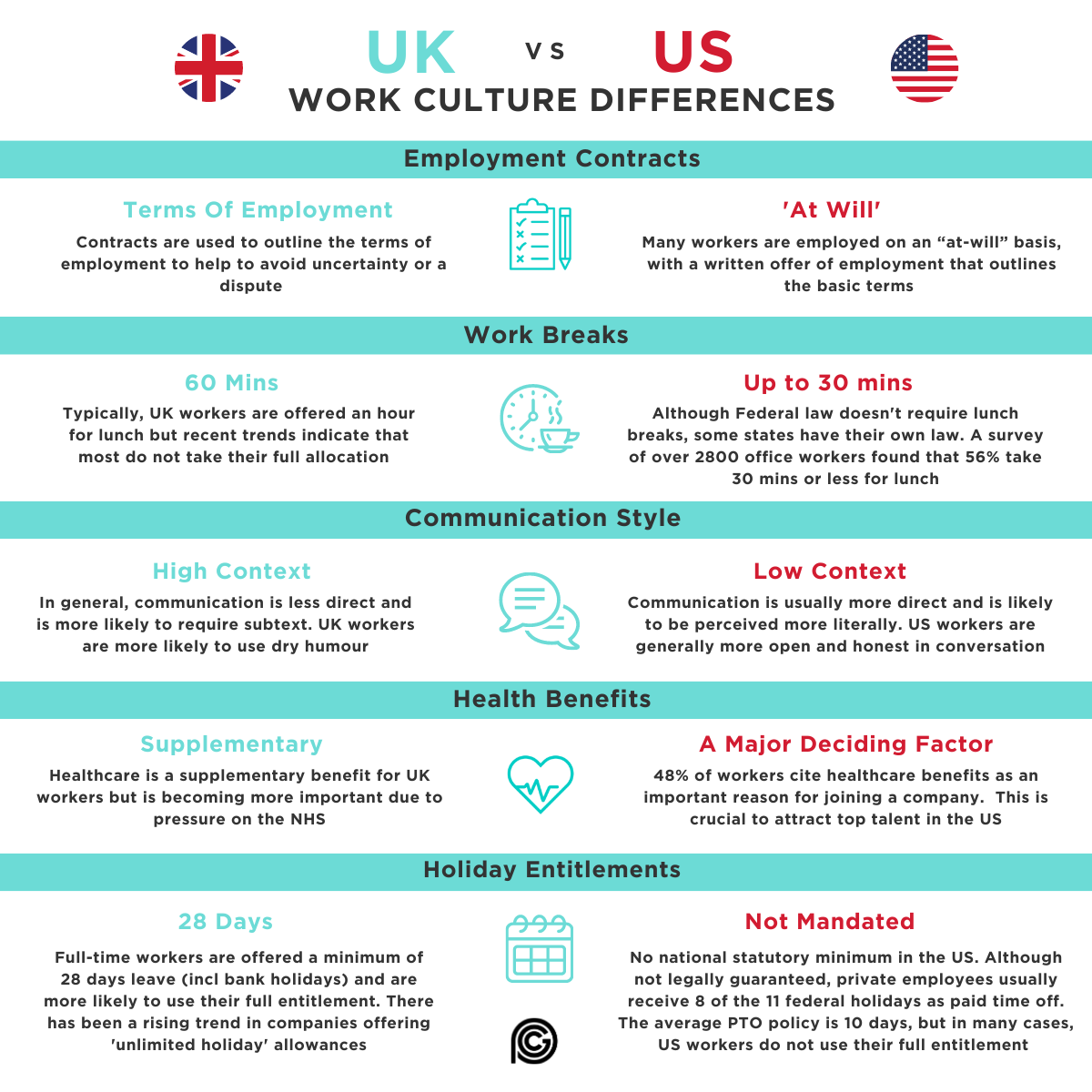

Cultural Differences Between the US and UK

It’s very important to be aware of the culture differences between the UK and US, when speaking to not only potential US clients, but candidates. Terms of employment, language, health benefits, and much more differ greatly. The infographic below is a summary of some of the major UK vs US work culture differences to be aware of when recruiting in the US staffing industry.

Is AI impacting the Recruitment Industry?

The impact of artificial intelligence (AI) on the recruitment industry has been significant. As technology continues to grow and evolve, it is affecting all parts of the US staffing industry, from the demand for specific skills to the way staffing firms deliver their services. Chatbots, for example, did not exist ten years ago, but are now being used by companies to enhance their services and products.

AI is enhancing service delivery

One major trend in technology is the use of platforms to deliver staffing services. This differs from the traditional staffing model, which involves a lot of handholding and dialogue between the client and the candidate. Instead, staffing platforms provide temporary workers and have seen huge growth in recent years. Aya Healthcare is a US healthcare company that transitioned to a platform model and grew from $1.1 billion in 2018 to $11 billion in 2022, demonstrating the incredible potential for growth with this approach.

AI enhances current products

AI is also impacting the US staffing industry by enhancing existing products and services, from job boards to the back office. With this technology, staffing firms can deliver more effective and efficient services, saving time and money in the process. As AI continues to develop, it will undoubtedly have an even greater impact on the recruitment industry, driving innovation and change in the years to come.

Ready to Start Recruiting in the US Staffing Industry?

To summarize, the US is still a significant market with plenty of opportunities, but it's important to understand the different characteristics state by state and do reliable research before planning to expand there. The recruitment industry is constantly evolving with the growth of technology, and it's essential to keep up with the latest trends and innovations to stay ahead.

This is where companies like SIA and PGC come in, providing reliable research and guidance to help businesses succeed in the US staffing industry. If you're planning to recruit from afar in a new state or want to stay ahead in the recruitment industry, it's important to seek expert advice and stay informed about the latest developments.

Disclaimer: The information provided here does not, and is not intended to, constitute legal or accountancy advice. Instead, the information and content available are for general informational purposes only.